student loan debt relief tax credit virginia

If a student has 18000 in loans with a standard 10-year repayment and 6 interest how much will that students payments be each month. Virginia debt relief programs.

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

But as much debt as we have most people dont really know.

. A one-year continuation award is also available for an additional up to 30000 in. Student loan debt relief tax credit virginia. From July 1 2022 through September 15 2022.

Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. CUMBERLAND Comptroller Peter Franchot urges eligible Marylanders to apply for the Student Loan Debt Relief Tax Credit Program by Sept. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit.

304-232-8600 Call Us Today or Use the Form Below to Request a. Debt collection in Virginia. Marylanders struggling with student debt have a week left to get some help with their loans from the state.

In fact by consistently providing convenient and reliable debt consolidation loan services Virginia Credit First Financial has come to be known as the best debt consolidation loan. 1 Best answer. Filing for bankruptcy in Virginia.

LSC Loan Repayment Assistance Program. In this scenario the student would be. Sep 6 2021.

Up to 5600 yearly for 3 years. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. It was established in 2000 and is an active part of the American Fair.

If you need debt relief in Virginia credit counseling agencies nonprofit and for-profit banks credit unions and online lenders. CuraDebt is a debt relief company from Hollywood Florida. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help. Virginia excludes the total and permanent disability discharge from income on state income tax returns but only for veterans and only through 2025. WRIC Virginia Attorney General Jason Miyares along with attorneys general from 9 other states has finalized an agreement to forgive the debt of.

About the Company Virginia Tax Refund Relief For 2021. In addition to credits Virginia offers a number of deductions and subtractions from. Review the credits below to see what you may be able to deduct from the tax you owe.

Friday June 3 2022. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program. The minimum reward for two years of service is 30000 and the maximum is 100000.

Complete the Student Loan Debt Relief Tax Credit application. Applications for the Maryland Student Loan Debt Relief Tax Credit. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to.

Virginia Loan Forgiveness Program for Law School. Tips to tackle debt in Virginia. It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

Financial relief is coming. June 4 2019 537 PM. The private student loan debt relief also includes other non-subprime private student loans made by Sallie Mae Bank and other lenders between 2002 and 2014 for.

McIntire Associates LC. How to apply. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit.

Taxpayers who have incurred at least 20000 in undergraduate or graduate student loan debt and have a minimum of 5000 in outstanding student loan debt are. Are here to help you start fresh. Payday lending laws in Virginia.

Recipientsof the Student Loan Debt Relief Tax Credit must within two years from theclose of the taxable year for which the credit applies pay the amount awardedtoward their college loan. Debt Relief Programs in Virginia. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve.

Americans owe over 4 trillion including over 1 trillion in student loans and another 1 trillion in revolving debt like credit cards. If you are facing student loan debt in West Virginia Thomas E.

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Student Loan Forgiveness New Study Shows Who Benefits Most Money

Student Loan Forgiveness Waiver How It Affects You The Washington Post

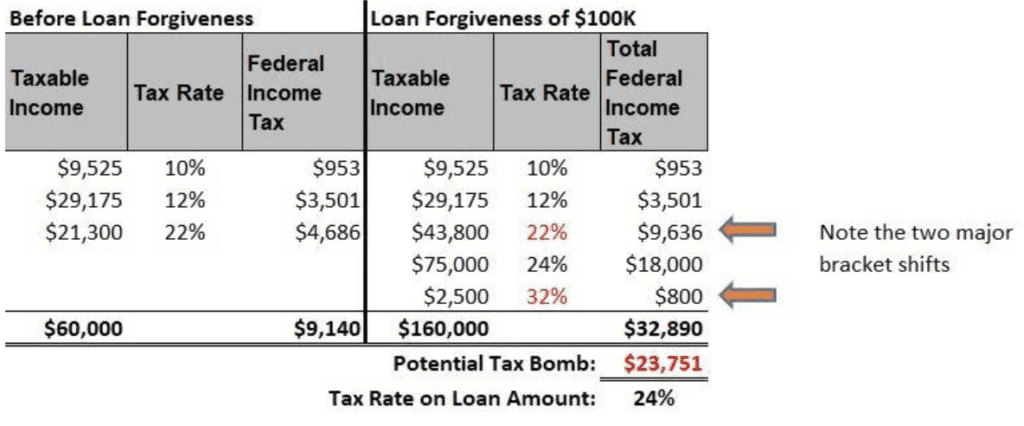

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

New Search Tool Finds Employers Who Help Pay Student Loans Money

Delay On Student Debt Cancellation Decision Has Borrowers Anxious The Washington Post

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Here S What Biden S Student Debt Forgiveness Could Look Like

Student Loan Forgiveness Programs Complete List The College Investor

Virginia College Loan Forgiveness Options Debt Strategists

Student Loan Forgiveness Programs For Relief Mass Forgiveness Student Loan Hero

Lawmaker Says Biden Must Restart Student Loan Payments And Student Loan Forgiveness Is A Terrible Idea

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Learn How The Student Loan Interest Deduction Works

Student Loan Forgiveness Good For The Economy Treasury Secretary Says

New Options For Student Loan Forgiveness